I entered my insurance coverage details online but it states "pending"? This implies the insurance information you went into did not confirm with your insurance provider's data source right away. It does not imply you are not guaranteed – underinsured. If you just bought a brand-new policy, it may take a number of days for the business to verify it.

If you believe the DMV has incorrect information, please call NVLIVE The info on documents can be looked into to validate if you are required to come right into the office. This can indicate we did not receive a feedback from the registered proprietor within the (15) days feedback time or the insurance policy business did not react to our notice within their (20) day action time.

If there is an actual lapse in coverage, you will certainly have to Learn more here adhere to the treatments under Reinstatements & Penalties. You might not lawfully drive the lorry as of the suspension date noted in the letter. I got a letter that states "disregard" or "retracted" (car insurance). The "disregard" letter suggests your insurance policy company has actually reacted to the confirmation card sent to you by verifying your insurance coverage information.

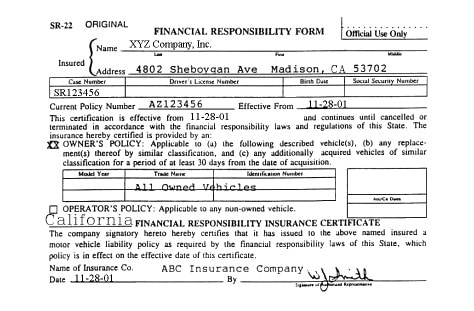

This means your insurance business validated coverage with the DMV, and nothing even more is required. Exactly how does this connect to an insurance reinstatement? "SR-22 Insurance policy" is a Certificate of Financial Obligation that your insurance coverage firm will submit with the DMV.

The Best Guide To Facts About Driving Uninsured – Scdmv

The fine for the gap of insurance policy may still use. I will be auto parking my automobile as well as may acquire "garage" insurance policy. Garage insurance policy is NOT responsibility insurance coverage, and therefore is not acceptable or reported to the DMV.

If you go down the responsibility insurance coverage for any factor, you need to terminate the registration and surrender the license plates. NVLIVE verification applies just to liability insurance coverage (insurance companies). See License Plate Give Up. Please inspect with your insurance policy representative to confirm whether you have liability protection. I'm having a conflict with my insurance coverage company/agent.

In Wisconsin, You Have to Have an SR-22 for a Minimum of Three Years There is a lot of confusion bordering both SR-22s and OWI offenses generally. An SR-22 is a kind that your insurer files with the DMV to accredit that you are guaranteed after being classified as a high-risk driver. Will Insurance Fees Remain High? Your insurance coverage prices are likely to remain high for about five years, depending on your provider.

Greet to Jerry, your new insurance policy agent (division of motor vehicles). We'll contact your insurer, examine your current plan, then find the coverage that fits your demands and also saves you cash.

Some Of Reinstatements – Tn.gov

If you have an existing plan you may have the ability to add your SR-22 to your policy through your insurance provider. If your cars and truck insurance coverage had been canceled as a result of your recent driving crime, then you should suggest that you call for the SR-22 insurance on your application. SR-22 is extremely comparable to common automobile insurance, nonetheless, it will be much more expensive.

insurance group division of motor vehicles sr22 coverage department of motor vehicles sr22 insurance

insurance group division of motor vehicles sr22 coverage department of motor vehicles sr22 insurance

Even if you are not an automobile proprietor, you will be needed to submit an SR-22 for non-owner status. This is a little cheaper than normal SR-22 however can be expensive. In Illinois, SR-22 insurance coverage is required for three constant years. If you do not renew your policy on time, then your certificate as well as registration will promptly be suspended and you will start the driver's permit reinstatement procedure, including requesting a new Illinois Drivers License Reinstatement Hearing.

If you move out of the state of Illinois you have the ability to waive your responsibility of filing an SR-22 in the state of Illinois by submitting a sworn statement, nonetheless, it is exceptionally most likely that you will need to acquire SR-22 insurance coverage in the brand-new state. There are really few alternatives to SR-22 insurance coverage as the state has flagged you as an at-risk motorist, consequently, the choices are unusual and pricey.

Conversely, you could deposit a guaranty or realty bond – sr-22. For more details browse through the Assistant of State website.

What Does Sr-22 Insurance: What Is It And How Does It Work? – Kelley … Do?

It is very important to bear in mind that your need to maintain the SR-22 insurance policy for the specified amount of time or your license is suspended once again. sr-22. If your policy terminates or lapses for any type of factor the insurance coverage firm is legally bound to submit a SR-26, which informs the state of the policy cancellation.

sr22 coverage bureau of motor vehicles car insurance liability insurance sr22

sr22 coverage bureau of motor vehicles car insurance liability insurance sr22

When your present provider does not issue SR22 types it's time to do some research study. When wanting to acquire an SR22 there are a few points to take into consideration: 1) Ensure the insurer is licensed to do company in the state of MO (driver's license). 2) Like with everything else, experience matters.

Why do I require an SR22 if I do not possess a vehicle? Every state that requires an SR-22 filing, requires that you have actually the state mandated liability protection whether you are an auto owner or a non-owner (do not very own auto).

By needing you to have SR22 insurance policy with or without an auto, the state feels they are securing the various other chauffeurs on the road. Where can I obtain an SR22? As discussed over, not all insurer offer SR22s., powered by Wessell Insurance policy Services, llc, has actually been supplying vehicle insurance coverage since 2006 (ignition interlock).

The Facts About What Is Sr-22 Insurance And Who Needs It? – Credit Karma Uncovered

It is not insurance policy or coverage, yet a way your state ensures your vehicle insurance coverage is energetic. Key Takeaways An SR22 is a form your auto insurance business sends to the state so you can abide with court- or state-ordered demands.

insure insurance companies auto insurance dui vehicle insurance

insure insurance companies auto insurance dui vehicle insurance

You need to keep an SR22 for a set length of time, such as one or 3 years, per the laws in your state. SR22s can be submitted with both common insurance policy coverage plans as well as non-owner insurance. What Is an SR22? This document shows that you have satisfied your financial responsibility for having the minimum responsibility insurance protection.

You call your insurance carrier, and also they need to release you the form when you have actually bought the minimum amount of car insurance – driver's license. You'll need to preserve the minimum amount of coverage and also make certain you have an existing SR22 type through set by the state you stay in.

The SR22 can cost regarding $25 in filing charges. Your insurance costs will raise as a result of the offense. As a whole, a DUI-related SR22 might lead to an increase in insurance expenses by between 20% as well as 30% – liability insurance. Yet an SR22 issued for uninsured driving is around $30 as well as can rely on your credit scores.

The Greatest Guide To Frequently Asked Questions – Iowa Dot

If you don't possess an automobile yet have to file an SR22 because of a sentence, you'll need to ask your agent about a non-owner plan (auto insurance). These policies cover your driving when you drive another person's automobile or a rental and also expense much less than insuring a car. If you change insurance provider while you have an SR22, you'll need to apply for a new SR22 prior to the first strategy expires.

sr-22 insurance auto insurance coverage dui deductibles

sr-22 insurance auto insurance coverage dui deductibles

This kind tells the state regarding the modification. underinsured. Obtaining the declaring got rid of might lower your prices on your insurance coverage. Exactly how Do I Figure out if I Still Need SR22 Insurance Policy? You'll need to get in touch with the firm that provided the initial requirement to establish if the declaring is still required. The agency will certainly be either the state DMV or the court system.

In some states, if you cancel your SR22 filing early, you may be required to reactivate the period over once again, also if you were just a few days from the date it was readied to end (insurance).

deductibles motor vehicle safety motor vehicle safety bureau of motor vehicles dui

deductibles motor vehicle safety motor vehicle safety bureau of motor vehicles dui

An SR-22 is a certificate of financial duty required for some chauffeurs by their state or court order – insure. An SR-22 is not a real "kind" of insurance policy, however a form submitted with your state.

A Biased View of Reinstatements – Tn.gov

Not everyone needs an SR-22/ FR-44.: DUI convictions Negligent driving Crashes triggered by without insurance vehicle drivers If you require an SR-22/ FR-44, the courts or your state Motor Automobile Division will certainly alert you.

Existing Customers can contact our Customer support Division at ( 877) 206-0215. We will certainly review the coverages on your plan as well as begin the process of filing the certification in your place. Exists a cost related to an SR-22/ FR-44? Most states bill a flat charge, however others need a surcharge. This is an one-time cost you must pay when we file the SR-22/ FR-44.

A filing cost is charged for every specific SR-22/ FR-44 we file. For instance, if your spouse is on your plan and both of you need an SR-22/ FR-44, then the filing fee will be charged two times. Please note: The charge is not included in the price quote because the declaring cost can differ (insurance).

Your SR-22/ FR-44 must be legitimate as long as your insurance coverage plan is active. If your insurance coverage plan is terminated while you're still called for to lug an SR-22/ FR-44, we are required to notify the proper state authorities.

Fascination About Sr22 Insurance Michigan – Blog

A Tennessee SR22 can be needed for an overall of 5 years from your date of suspension. If the Tennessee SR22 is filed for a total of 3 years (36 months) within the 5-year period, the SR-22 might be terminated supplied it is not needed on any kind of various other suspension. If 5 years pass from the date of suspension prior to you restore your benefits, after that the Tennessee SR22 would not be called for.

The SR-22 requirement starts on the day of the conviction. You are the owner of a lorry that was without insurance at the time of a crash. The SR-22 requirement begins on the date of the accident. You are attempting to restore your driving benefits. The SR-22 need begins on the end day of the suspension.

The SR-22 demand starts when you obtain the authorization and ends when the permit runs out. Please call DMV to see if you require to get an SR-22. Out of State Filing, Even if you endure of state, you should file an SR 22 with Oregon (if needed) before another state can release you a vehicle driver permit.

Any type of Colorado homeowner who has had their vehicle driver's certificate withdrawed for driving intoxicated is required by the Division of Profits, Department of Electric Motor Cars (DMV) to get "Proof of Insurance" prior to reinstatement of their driving advantages. This form of insurance policy, referred to as an SR-22, calls for the insurance coverage service provider to report any type of lapse in insurance policy coverage to the Colorado Automobile Division.